March 9, 2026

Employee Benefits Enhancements

Over the past year, HR has been carefully evaluating ways to improve the enrollment experience and strengthen the benefits available to our employees. We are excited to announce April 1, 2026, we will launch Employee Navigator, a new online benefits administration system that will allow employees to electronically enroll in or make changes to their coverage.

As part of preparing for this transition to an online platform, we conducted a review of our current benefit offerings. During this process, we identified several existing products that cannot be supported through electronic enrollment. To ensure a seamless move to the new system and to continue offering high quality benefits, MSU will offer similar or enhanced coverage options.

As a result, the following plans will be discontinued effective April 30, 2026, and will no longer be payroll deducted:

- Aflac Accident

- Aflac Cancer

- Aflac Critical Care

- Aflac Intensive Care

- National Fire Union AD&D

These plans will be replaced with a suite of new and updated Aflac offerings, including:

- Accident Insurance

- Cancer Insurance

- Critical Care Insurance

- Hospital Indemnity

- Term Life Insurance with Long-Term Care included

Employees currently enrolled in any of the plans scheduled for discontinuation will receive direct communication with details about this transition. In addition, all benefits eligible employees will have the opportunity to enroll in the new Aflac plans during our upcoming enrollment period April 1–15, 2026.

More information will be shared in the coming weeks. Please watch for additional communication from HRM outlining next steps, plan details, and important dates. We will also host an informational webinar to help employees learn more about the new Aflac options and navigate the transition to Employee Navigator.

We look forward to rolling out these enhancements and supporting you through each step of the transition.

March 2, 2026

Pharmacy Changes to the State Health Plan

Specialty Medication Cost Calculations (Base and Select Plans)

Effective 2026, manufacturer copay assistance programs (“copay cards”) for specialty medications will no longer count toward your annual deductible or out‑of‑pocket (OOP) maximum. Only the amount you actually pay will apply toward your calendar‑year deductible (CYD) and OOP maximum. You may continue using copay cards; however, any dollars you receive from the manufacturer will no longer count towards your deductible or OOP maximums.

Introduction of PrudentRx for the Select Plan

Effective 2026, the Select Plan will add an optional program called PrudentRx for specialty medications included on the PrudentRx drug list. Participants who enroll in PrudentRx will pay $0 out‑of‑pocket for eligible specialty medications by maximizing available manufacturer assistance (coupons, copay cards, etc.).

- If you do not enroll, a 30% coinsurance will apply to specialty medications.

- Third‑party assistance used through PrudentRx will not count toward your CYD or annual OOP maximum.

Eligible participants will receive additional details and instructions on how to enroll.

February 12, 2026

Tier 5 Retirement Plan will be implemented March 1, 2026

The Public Employees' Retirement System of Mississippi (PERS) will implement a new retirement tier—Tier 5—following passage of House Bill 1 during the Mississippi Legislature’s 2025 session.

Tier 5 is designed as a hybrid retirement plan, combining elements of both a defined benefit (DB) pension plan and a defined contribution (DC) plan.

Who Is Affected?

Membership in Tier 5 applies to individuals who:

-

Are hired into PERS-covered positions on or after March 1, 2026, and

-

Are new to PERS, or

-

Previously participated in PERS but refunded their contributions.

Contribution Structure

Employees enrolled in Tier 5 will contribute a mandatory 9% of salary, allocated as follows:

-

4% to the defined benefit (DB) component

-

5% to the defined contribution (DC) component

Vesting Requirements

Employees in Tier 5 will vest after eight years of service.

Additional details about Tier 5, including plan design and frequently asked questions, are available on the PERS website:

https://www.pers.ms.gov/Tier5

November 4, 2025

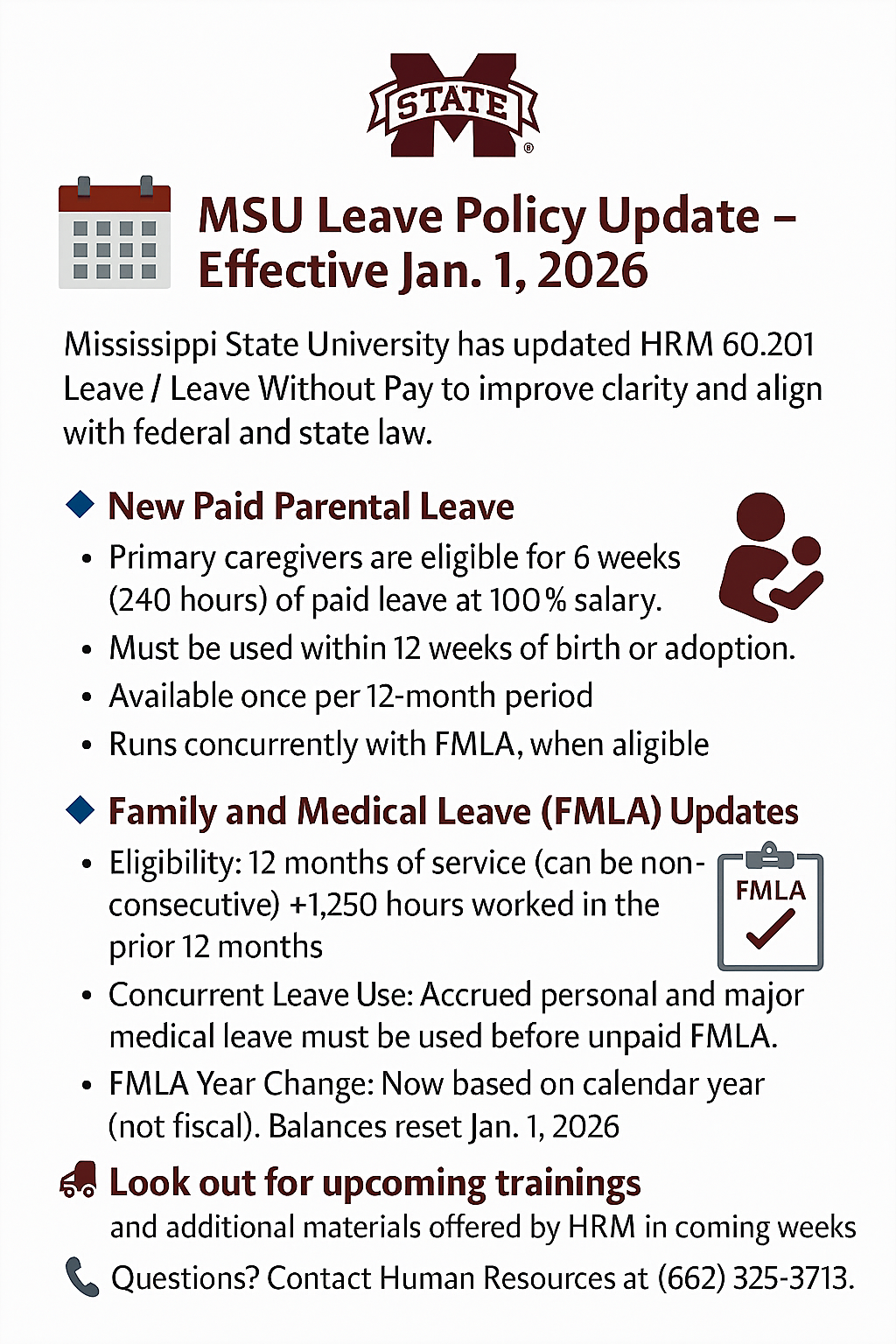

MSU Leave Policy Changes

October 28, 2025

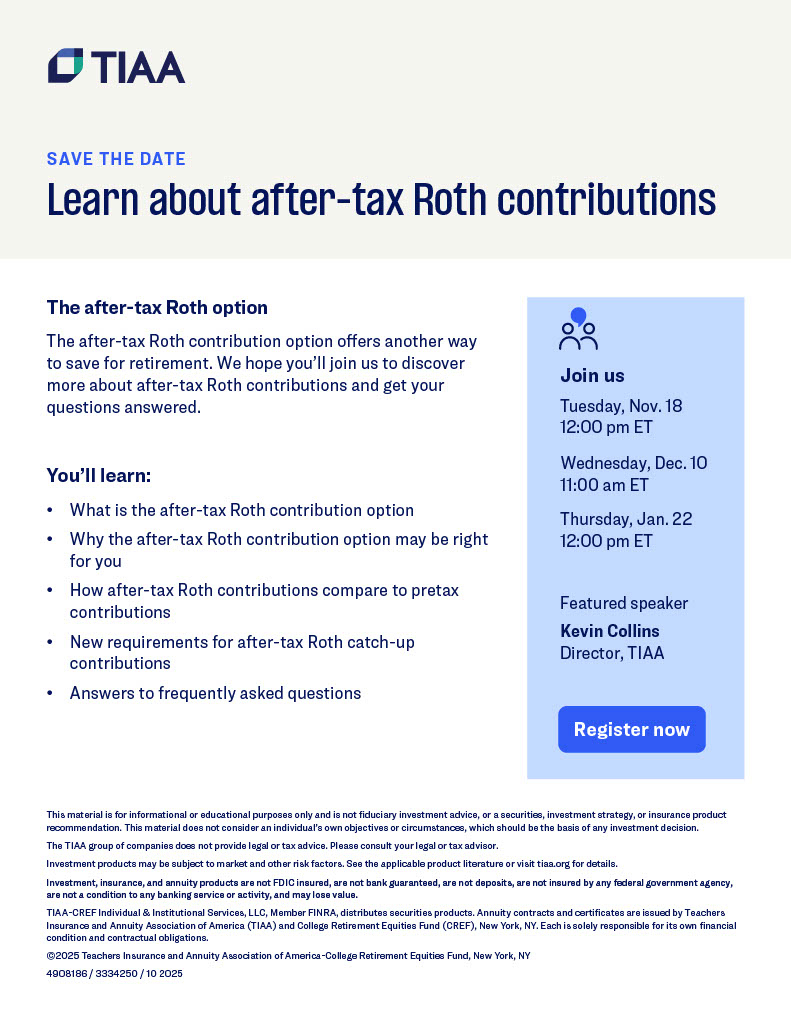

TIAA ROTH Contribution Webinar